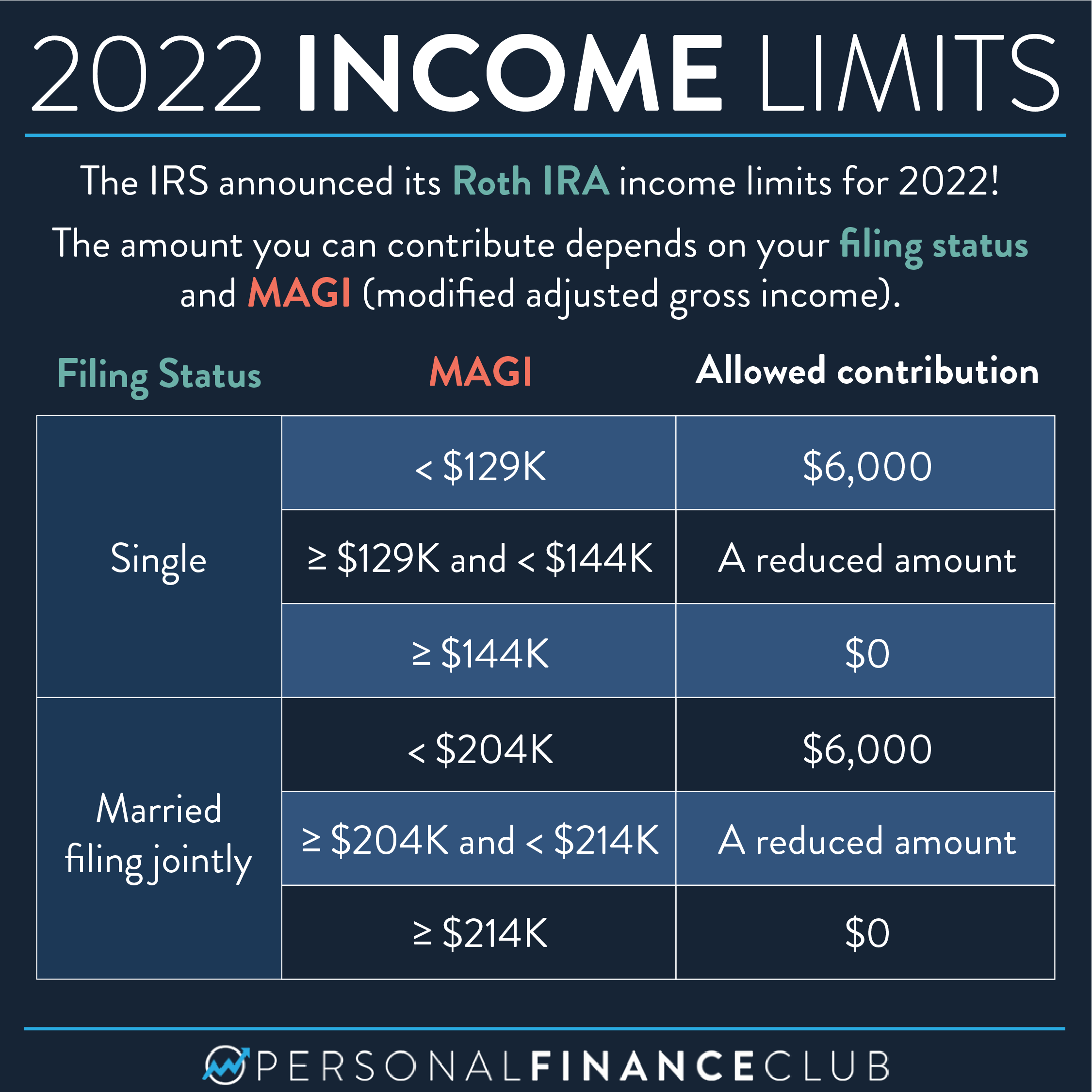

Roth Contribution Limits 2024 Irs.Gov Irs Website. The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older. For 2024, your roth ira contribution limit is reduced (phased out) in the following situations.

Whether you can contribute the full amount to a roth ira depends on your income. See the table and the formula to calculate your reduced contribution limit based on your filing status and income.

Roth Contribution Limits 2024 Irs.Gov Irs Website Images References :

Source: arianabcristionna.pages.dev

Source: arianabcristionna.pages.dev

2024 Roth Ira Contribution Limits Tables For 2024 Rosie Claretta, If you're 49 and under, you can.

Source: dianaqmelanie.pages.dev

Source: dianaqmelanie.pages.dev

Roth Ira Limits 2024 Irs Brett Clarine, Find out the contribution limits, income eligibility, and distribution rules for 2023 and 2022.

Source: delyaubrette.pages.dev

Source: delyaubrette.pages.dev

Roth 401 K Contribution Limit 2024 Tabby Carolin, See the tables for tax years 2023 and 2024, and find out how to use 529 rollover assets.

Source: joelaqcristen.pages.dev

Source: joelaqcristen.pages.dev

Roth 2024 Contribution Limit Irs Teena Atlanta, The treasury department and the irs have determined that a transaction in which the promotional materials offer the taxpayer the possibility of being allocated a charitable.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

401k And Roth Ira Contribution Limits 2024 Cammy Caressa, Your personal roth ira contribution limit, or eligibility to contribute at.

Source: drediymeriel.pages.dev

Source: drediymeriel.pages.dev

Roth Contribution Limits 2024 Tax Rate Lin Meredithe, Find out the contribution limits, income eligibility, and distribution rules for 2023 and 2022.

Source: devonvcorissa.pages.dev

Source: devonvcorissa.pages.dev

Roth Ira Contribution Limits 2024 Irs Nixie Nollie, Find out the contribution limits, income eligibility, and distribution rules for 2023 and 2022.

Source: renaeycharlotta.pages.dev

Source: renaeycharlotta.pages.dev

Roth Contribution Limits 2024 Married Filing Jointly Elga Nickie, The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: dixybellina.pages.dev

Source: dixybellina.pages.dev

2024 Roth Ira Contribution Limits Magi Calculator Cally Corette, For 2024, the roth ira contribution limits are going up $500.

Source: edithaykarmen.pages.dev

Source: edithaykarmen.pages.dev

401k Catch Up 2024 Roth Or Traditional Tony Aigneis, The irs reviews and updates the maximum 401(k) contribution limits every year.

Category: 2024