2024 Irs Section 179. Understanding the basics of section 179 deduction in 2024. Under the 2024 version of section 179, the deduction threshold in terms of the value of new equipment purchases is $3,050,000.

A section 179 expense is a business asset that can be written off for tax purposes right away rather than being depreciated over time. Section 179 deduction is a tax provision designed for small businesses, allowing them to deduct the full purchase price of qualifying assets in the year they are placed in service.

The Section 179 Deduction Is A Valuable Tax Incentive For Businesses, Especially Small And Medium Enterprises.

Financing equipment through crest capital allows your business to truly leverage the 2024 section.

Updated On January 19, 2023.

Section 179 deduction is a tax provision designed for small businesses, allowing them to deduct the full purchase price of qualifying assets in the year they are placed in service.

In 2023 (Taxes Filed In 2024), The Maximum Section 179.

Images References :

Source: vermeerallroads.com

Source: vermeerallroads.com

Section 179 Tax Deduction, Tax provisions accelerate depreciation on qualifying equipment, office furniture, technology, software and other business items. In contrast, bonus depreciation is limited to 80 percent for 2023 (60 percent for 2024).

Source: loutitiawjoyan.pages.dev

Source: loutitiawjoyan.pages.dev

Section 179 Vehicles List 2024 Lynde Ronnica, Understanding the basics of section 179 deduction in 2024. Irs section 179 covers business deductions for.

Source: www.netsapiens.com

Source: www.netsapiens.com

Section 179 IRS Tax Deduction Updated for 2021, Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),. Section 179 of the irs tax code allows businesses to deduct the full purchase price of qualifying new and used equipment, vehicles (restrictions apply) and.

Source: airforceone.com

Source: airforceone.com

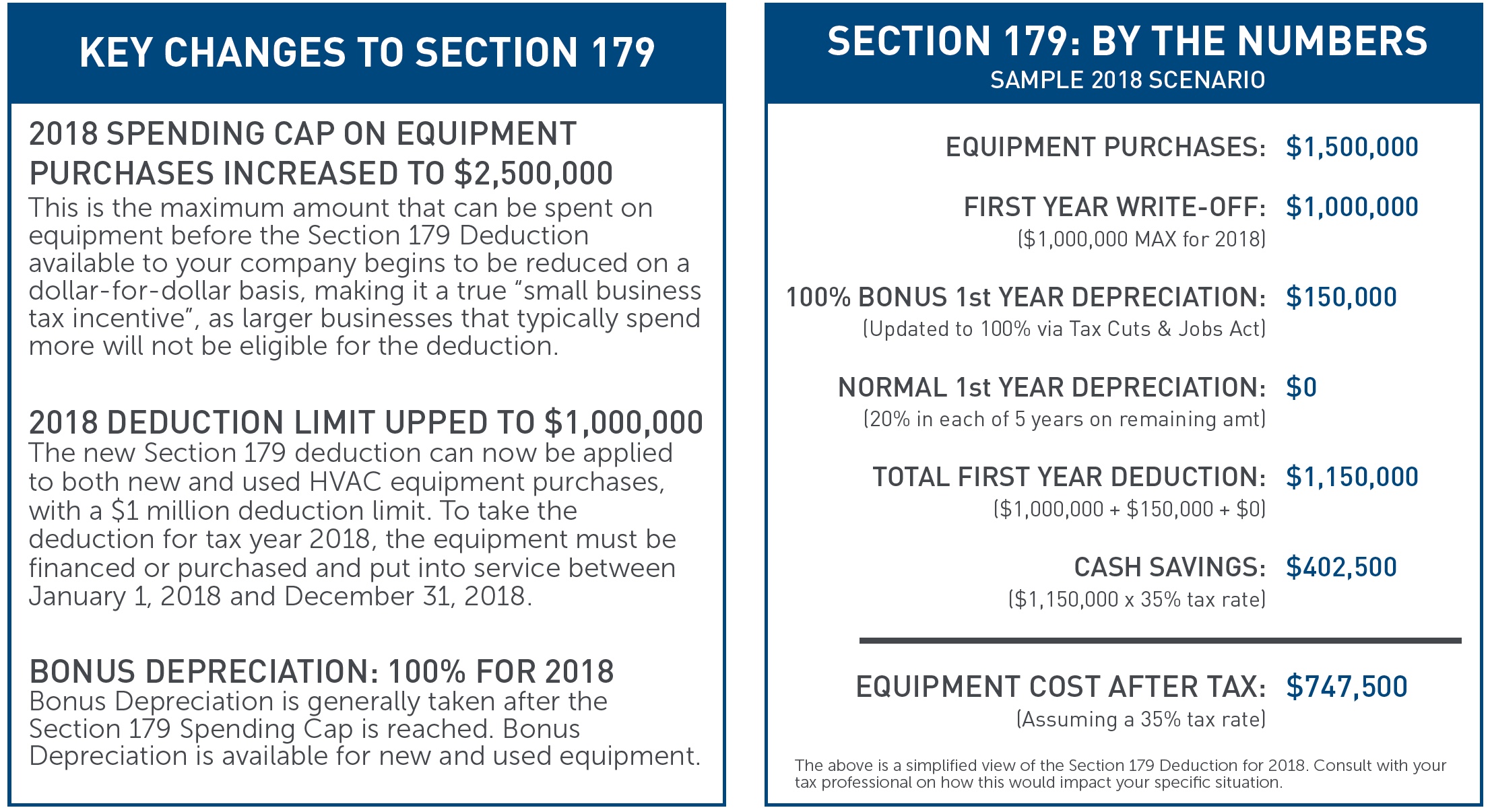

CHANGES TO IRS SECTION 179 WHAT IT MEANS FOR FACILITY OWNERS Air, Section 179 vehicles list 2024 lynde ronnica, for the 2023 tax year, section 179 deduction allows business owners to deduct up to $1,160,000 ($1,220,000 for 2024) of the cost of. A section 179 expense is a business asset that can be written off for tax purposes right away rather than being depreciated over time.

Source: www.youtube.com

Source: www.youtube.com

Section 179 IRS FORM Explained… YouTube, Section 179 deduction dollar limits. For tax years beginning in 2024, the maximum section 179 expense deduction is $1,220,000.

Source: blog.burkett.com

Source: blog.burkett.com

What is Section 179 of the IRS Tax Code? The Burkett Blog, Section 179 deduction dollar limits. Under the 2024 version of section 179, the deduction threshold in terms of the value of new equipment purchases is $3,050,000.

Source: www.youtube.com

Source: www.youtube.com

Depreciation 101 Is the Section 179 Deduction Right for your Business, Financing equipment through crest capital allows your business to truly leverage the 2024 section. There also needs to be sufficient business income during.

Source: jewelqloralee.pages.dev

Source: jewelqloralee.pages.dev

Tax Brackets 2024 Irs Tera Abagail, While irs section 179 generously allows businesses to write off substantial amounts immediately rather than over several years through depreciation. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.

Source: qtemfg.com

Source: qtemfg.com

2022Section179deductionexample QTE Manufacturing Solutions, Financing equipment through crest capital allows your business to truly leverage the 2024 section. For 2024, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2023).

Source: www.luxurylav.com

Source: www.luxurylav.com

Understanding Section 179 Deduction for Restroom Trailers, For 2024, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2023). The section 179 deduction limit for tax year 2023 is $1,160,000 with an investment limit of $2,890,000.

Section 179 Of The Irs Tax Code Lets A Business Deduct The Full Purchase Price Of Qualifying Equipment Within The Year It’s Purchased Instead Of Writing Off Small.

Section 179 deduction dollar limits.

Claiming Section 179 Depreciation Expense On The Company’s Federal Tax Return Reduces The True Cost Of The Purchase To $130,000 (Assuming A 35% Tax Bracket),.

Section 179 deduction is a tax provision designed for small businesses, allowing them to deduct the full purchase price of qualifying assets in the year they are placed in service.